If you have an analytical mindset, love learning about new industries, and are a bit of a go-getter, the world of investment banking may seem like a perfect place for you. Indeed, the earning potential here is immense. Senior professionals can command well above six figures per year as a base salary, plus receive lavish performance bonuses.

However, breaking into this industry may require persistence and stellar credentials. Investment banking is a competitive niche where just a few of the many applicants get accepted. A compelling resume will be essential to get your foot in the door.

In this post, you’ll find several investment banking resume examples for different roles in the industry, followed by tips on resume writing, formatting, and design.

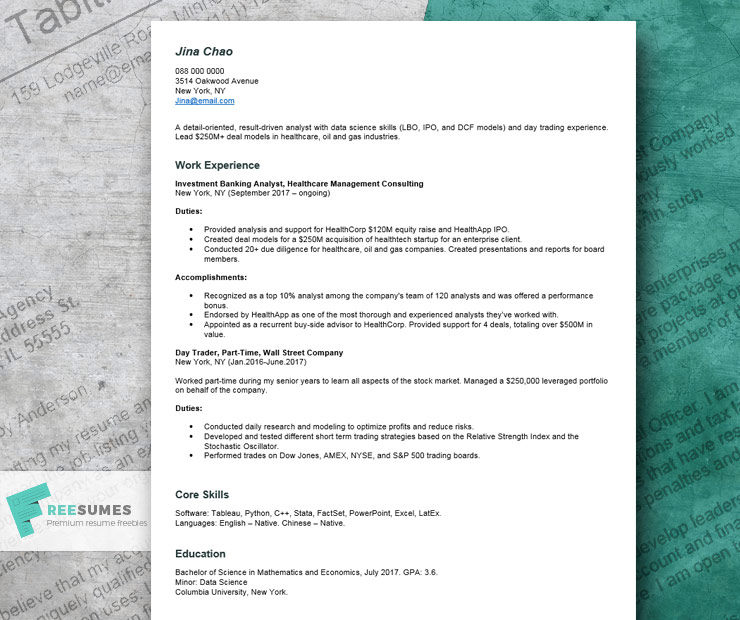

Investment Banking Analyst Resume Example (Word)

Download resume example (.docx)

Investment Banking Analyst Resume (plain text)

A detail-oriented, result-driven analyst with data science skills (LBO, IPO, and DCF models) and day trading experience. Lead $250M+ deal models in healthcare, oil, and gas industries.

Investment Banking Analyst, Healthcare Management Consulting

New York, NY (September 2017 – ongoing)

Duties:

- Provided analysis and support for HealthCorp’s $120M equity raise and HealthApp IPO.

- Created deal models for a $250M acquisition of healthtech startup for an enterprise client.

- Conducted 20+ due diligence for healthcare, oil, and gas companies. Created presentations and reports for board members.

Accomplishments:

- Recognized as a top 10% analyst among the company’s team of 120 analysts and was offered a performance bonus.

- Endorsed by HealthApp as one of the most thorough and experienced analysts they’ve worked with.

- Appointed as a recurrent buy-side advisor to HealthCorp. Provided support for 4 deals, totaling over $500M in value.

Day Trader, Part-Time, Wall Street Company

New York, NY (Jan.2016-June.2017)

Worked part-time during my senior years to learn all aspects of the stock market. Managed a $250,000 leveraged portfolio on behalf of the company.

Duties:

- Conducted daily research and modeling to optimize profits and reduce risks.

- Developed and tested different short-term trading strategies based on the Relative Strength Index and the Stochastic Oscillator.

- Performed trades on Dow Jones, AMEX, NYSE, and S&P 500 trading boards.

Core Skills:

Software: Tableau, Python, C++, Stata, FactSet, PowerPoint, Excel, LatEx.

Languages: English – Native. Chinese – Native.

EducationBachelor of Science in Mathematics and Economics, July 2017. GPA: 3.6.

Minor: Data Science

Columbia University, New York.

Sample Investment Banking Associate Resume

Chartered Financial Analyst (CFA)

Experienced investment banking professional, specializing in mutual and REIT funds management. Grew commercial REIT fund value by 25% through real estate market analysis and portfolio rebalancing.

Skills:

- Financial modeling

- Valuation analysis

- Market research

- Capital structure optimization

- Deal sourcing and preparation

- Client advisory

- Data analysis (Power BI, Tableau)

- Portfolio management

Work History

Investment Banking Associate, Build Holdings Inc

Miami, FL (June 2020 – present)

Member of real estate acquisition team at a boutique investment bank, specializing in commercial, residential, and healthcare REITs.

- Participate in deal sourcing, negotiation, and closing. Successfully acquired over $35 million in new real estate assets.

- Perform due diligence to assess the quality of the value of prospective real estate assets, property management practices, and tenant profiles.

- Benchmark the performance of managed REIT investments to optimize year-on-year growth. Achieved 15% YoY growth.

- Collaborate with customer advisors and marketing team on the creation of pitch books, presentations, and custom reports for investors.

- Conduct monthly portfolio reviews for 3 managed REITs and perform portfolio rebalancing as needed.

Junior Wealth Manager, Money Inc.

Miami, FL (June 2018 – May 2020)

Provided wealth management and investment banking consulting services to UHNW clients. Participated in new asset acquisition deals.

- Delivered financial analysis, risk tolerance assessment, and customized retirement plans for the firm’s customers. Recognized as the “Best Client Advisor of the Year” in 2019.

- Performed industry and market research to determine the most promising assets for portfolio diversification. Specialized in alternative investment classes: Commodities, private equity, and art.

- Opened 10 new client accounts in three months, exceeding the allocated quota. Retained new customers for over 24 months.

Investment Banking Intern, Ventra Inc.

Miami, FL (May 2017 – December 2017)

Was selected among 250+ applicants to participate in Ventra’s job shadowing program. Supported the team in M&A deals in the real estate sector.

- Created real estate trend market analysis using Matrix, TractionDesk, and Power BI.

- Liaised relationships between the seller, escrow, and agents.

- Developed forecasting models to predict different assets’ performance during the 5-year period.

Education

MA in Finance

Florida State University

May 2018

GPA: 3.8

BS in Statistics

Florida State University

June 2016

GPA: 3.7

Certifications

- Certified Chartered Financial Analyst by CFA Institute. October 2019.

- Certified Power BI Data Analyst Associate. April 2019.

Investment Banking Intern Resume Example

Second-year, MSF student at UCLA Anderson School of Management (May ’25), seeking a summer internship position. Strong knowledge of IPO transactions’ management, quantitative analysis, data modeling, and visualization.

Education

MSc in Finance

UCLA Anderson School of Management

Expected graduation date: May 2025

GPA – 3.8

Thesis subject: “Due diligence frameworks for valuations in the FinTech sector”

BS in Business Management

The University of California, Irvine

June 2022

GPA – 3.6

Deans’ list

Minor in data science

Work History:

Corporate Finance Intern

MGT Capital,

San Francisco, CA

Summer 2022

- Facilitated the execution of capital-raising transactions, including IPOs and private placements.

- Performed due diligence on client companies: Developed forecasts on revenue and margin trends; performed competitor analysis.

- Collaborated with Design Teams to create investor presentations, pitchbooks, and marketing collateral.

Investment Assistant Intern

Barks VC

M&A Intern

Irvin, CA

Winter 2021-22

- Performed industry research in video on demand (VOD), managed cybersecurity services, and big data analytics services market.

- Interviewed over 20 founders in the VOD market and delivered an in-depth report on the market growth forecasts for 2023-2025.

- Contributed to funding deals management by performing due diligence on potential targets; delivered cash flow models and valuation estimates.

Private Finance Inc

Investment assistant

Part-time

Irvin, CA

May 2019-December 2021

- Participated in gathering market information on startups in the EdTech and FinTech sectors. Contributes insights for investment decisions.

- Created cash flow forecasts, profitability prediction models, and product pricing recommendations for the managed portfolio of startups.

- Assisted in the preparation of presentations and market briefings for senior partners during biweekly meetings.

Professional certifications and extra curriculum courses

- Microsoft Data Analyst Associate Certification, issued in June 2020.

- Advanced Valuation and Strategy – M&A, Private Equity, and Venture Capital by Erasmus University, Rotterdam. Completed in May 2022.

- Alternative Investments course by Harvard University. Completed August 2023.

References available upon request

Pro Tip: What to Put on Your Resume for Investment Banking Internships?

To land an internship in the investment banking sector, clearly state your areas of expertise, whether it is driven by your research or past work experiences. Investment banking is a wide field. Hence, your resume should clearly communicate your range of competencies (e.g., deep knowledge of tech startup valuation and due diligence processes as in the sample above).

In addition, a compelling investment banking internship resume should:

- Explain what role you are seeking in your resume objective

- Highlight your academic achievements and extra-curriculums

- Demonstrate your ranges of quantitative and analytical skills

- Be aligned with the specific internship position

Positive letters of reference from previous employers or professors can be a major plus to your internship application packet.

Get more tips from our post about writing a resume for internship positions.

Recommended Investment Banking Resume Templates

Investment banking is a somewhat conservative industry. To avoid any faux pas, go with a professional resume template in muted colors. Avoid elaborate fonts or flash colors. A minimalistic resume design with a photo in a neutral color scheme is your best option.

Using a two-column resume template also makes sense for more experienced candidates, who want to effectively present more information in one page.

Here are our recommended resume templates for investment banking professionals.

- Executive edge resume template

- The Classic Pro resume template

- Fine balance professional resume template

- Executive grey resume template

- Free professional resume template

Browse even more free resume templates from our database.

Skills to Put on Resume for Investment Banking

Financial institutions want to see well-rounded candidates, who combine strong hard skills in finance with favorable character qualities like strong interpersonal skills, exceptional organizational abilities, and customer-centricity (for client-facing roles).

Of course, you can’t possibly pack every skill you have into a one-page resume. Prioritize the ones relevant to the role you’re seeking. Review the job description once again and pay attention to how the employer describes the duties and preferred competencies for the position. Then review your resume and sprinkle in those keywords in your work experience, education, and featured skills section.

Need some ideas? Here’s a list of sample investment banking skills for a resume:

Financial skills

- Mergers and Acquisitions (M&A)

- Due diligence

- Discounted cash flow (DCF) analysis

- Comparable company analysis (CCA)

- Precedent transaction analysis (PTA)

- Leveraged buyout modeling

- Risk management

- Markov chain analysis

- Credit risk modeling

- Equity and debt financing

- Breakeven analysis

- Cashflow forecasting

- SWOT analysis

- Income Investing Framework

- Fundamental Analysis

- Technical Analysis

- Market Opportunity Analysis

- PESTEL Analysis

- Modern Portfolio Theory (MPT)

- Capital Asset Pricing Model)

- Pitchbook preparation

- Deal sourcing

- Deal management

- Asset allocation

- Portfolio management

- Econometrics

- Compliance and regulatory knowledge

- Trading and execution

- Equity research

- Statistical analysis

Soft skills

- Pitching

- Presentation delivery

- Negotiation

- Customer relationship management

- Cross-team collaboration

- Adaptability

- Time management

- Ethical judgment

- Client focus

- Networking

- Leadership

- Salesmanship

- Cultural sensitivity

Technical skills

- Microsoft Excel

- Microsoft PowerPoint

- Bloomberg Terminal

- Thomson Reuters Eikon

- Morningstar Direct

- FactSet

- Capital IQ

- MATLAB

- Python

- R

- SQL

- Tableau

- Salesforce

- Alteryx

- S&P Capital IQ

- Stata

- Minitab

- QlikView

Writing Tips for Investment Banking Resume

Investment banking is a field that values clarity, consistency, and accuracy. Your resume should leave no doubt about your skills, areas of expertise, and educational credentials. Moreover, it should always quantify your achievements (to appeal to those analytical decision-makers) to showcase the impacts of your work.

Below are several more tips to help you create a standout investment banking resume.

Always Follow The Company’s Resume Formatting Instructions

Most established employers will provide detailed instructions on the preferred resume format and style. Goldman Sachs, for instance, specifically asks entry-level candidates to “place educational information at the top (i.e., the school you are attending, your majors and minors, your expected degree and graduation date)” and list professional experience and internship afterward, followed by any additional information on other activities and interests,

Other banks, on the contrary, may prefer the standard chronological resume, emphasizing the work experience section above everything else. So be sure to carefully review all the application instructions and follow them to the dot.

Optimize Your Resume For Applicant Tracking Software

Most top firms receive plenty of job applications for newly announced positions and even so much so for internships. The first barrier you’ll need to break through will likely be an applicant tracking system (ATS).

Over 98.8% of Fortune 500 companies use ATS to pre-screen applicants and select the most promising candidates. The good news is that you can make ATS work in your favor by optimizing your resume. This includes doing the following:

- Use a sans serif resume font as it’s considered more “readable” by machines.

- For the same reason, also use round bullet points for the work experience section.

- Add plenty of relevant keywords (taken from the job description and LinkedIn Skills tool).

Also, re-check your resume for any weird formatting as it won’t be properly interpreted by the software. Also, rough design and mismatched colors can easily diminish the otherwise positive impression your work history and education could make on a human reader.

Provide Facts And Figures

Hard facts and exact numbers matter a lot in the finance world. Every employer will expect to see tangible proof of your skills and accomplishments. Thus, have the numbers at hand and be ready to share how you’ve contributed to different types of projects.

Here’s a quick formula for parlaying your work history. First, explain what your responsibility was. Then tell what skill you’ve applied and afterward quantify the result. For example:

“Provided market analysis for a $35M retail acquisition deal. Created statistical models in LateX and data visualizations. Received praise from the client’s board for top-notch reporting”.

Stay Brief And On-Point

As a rule of thumb, your resume shouldn’t be longer than one page. It has to convey all the information efficiently and naturally draw attention to the most important areas – skills, education, and accomplishments. Use bold to highlight the key elements and leave plenty of white space in between sections for easier skimming.

Final Tip: Include Client Endorsements

If you’re after a client-facing role in investment banking, include direct quotes to make an even stronger first impression. The key here is to secure the permission in advance and choose to include letters that speak best to the qualifications you’ve highlighted in your resume.